Congressman Zach Nunn's Corporate Tax Priorities Are Out Of Whack

Congressman Zach Nunn supports billions of dollars in tax giveaways to large corporations. Iowa families are already paying more in taxes than some big corporations. It’s time for Zach Nunn to make those at the top pay their fair share.Learn more below about how big corporations get hundreds of millions of our hard earned tax dollars sent to them as a refund! And share the images below to help us spread the word that Congressman Nunn would make it even worse.

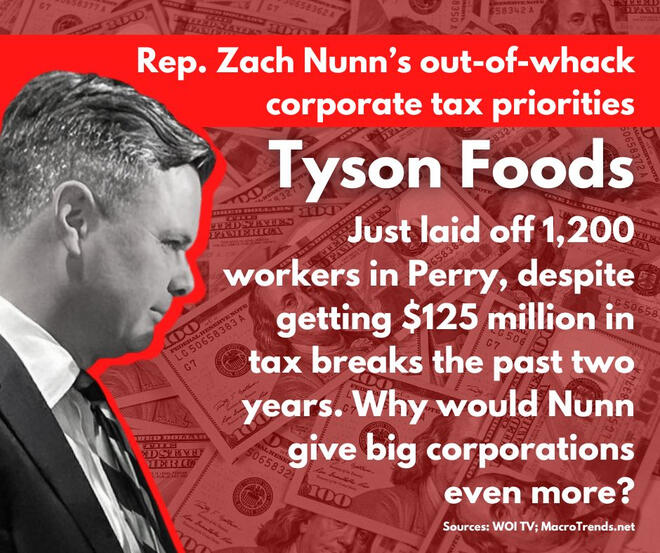

Tyson Foods

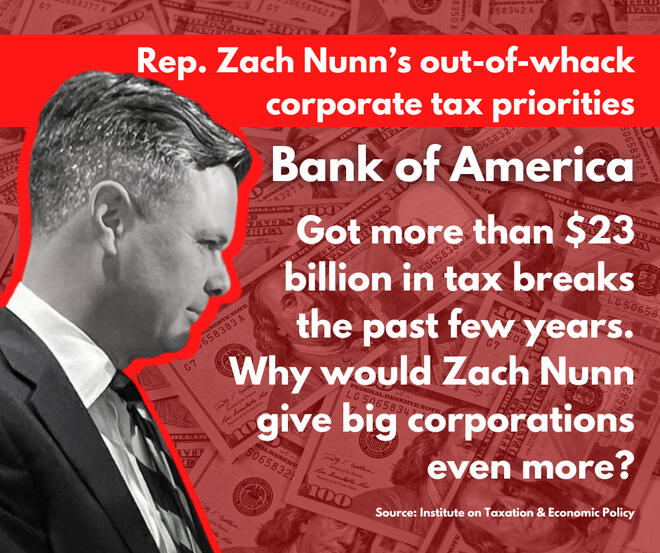

Bank of America

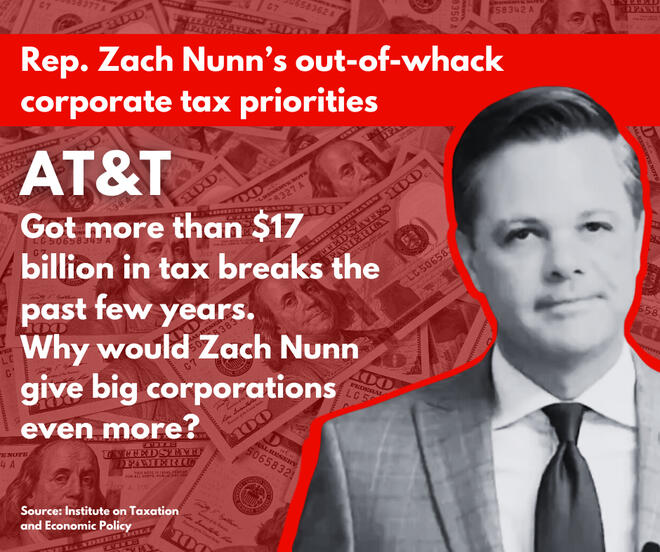

AT&T

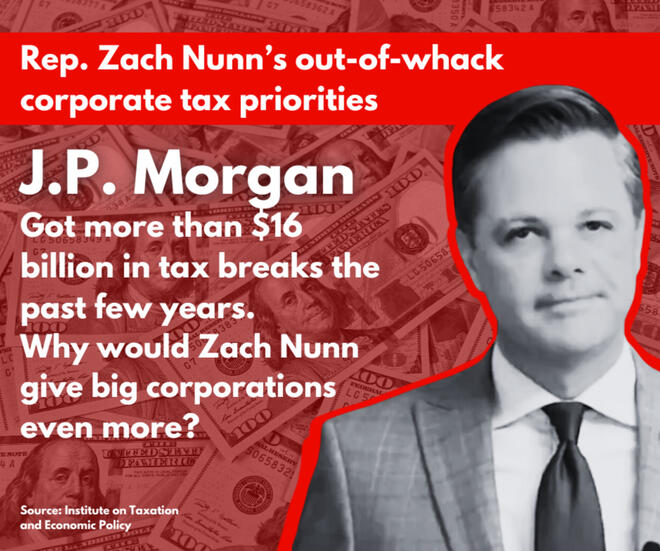

J.P. Morgan

Congressman Zach Nunn’s Record on Taxes:

Voted for tax breaks for corporations.

Sides with corporations and the wealthy over working people when it comes to taxes.

Votes to protect the wealthy and corporate tax cheats from paying their fair share. He voted to slash funding for the IRS to enforce laws to make them pay the taxes they owe.

Opposed a law that made the biggest corporations pay a 15% minimum tax. Now, he’s part of a group in Congress that wants to repeal that corporate minimum tax.

The 30% Zach Tax would would apply to nearly everything, including housing, health care, and groceries. You can use this form to calculate any of those costs as well.You may receive email updates from Progress Iowa, the sponsor of this form.

How Will the Zach Tax Affect Your Family?

Zach Nunn supported Kevin McCarthy (15 times!) as a backroom deal for a 30% national sales tax became part of the agreement to make him Speaker of the House.

Use this form to calculate how much the Zach Tax would increase your grocery bill and help us spread the word.

Your Grocery Bill Will Go Up To ${{url.calculation}}

Is your family ready to pay 30% more for groceries every month? Share this tool and tell Zach Nunn Iowa families don't want more taxes.